ad valorem tax calculator florida

Obtaining a homestead exemption will qualify you for two. For additional information on deadlines and application forms please contact the Property Appraisers office at 305-375-4125.

What Is A Homestead Exemption And How Does It Work Lendingtree

Ad valorem taxes are.

. Fidelity National Financial - Florida Agency. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. A lien against the property.

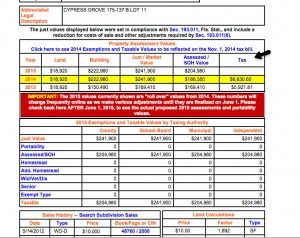

Choose a tax districtcity from the drop down box enter a taxable value in the. Use the reset button to enter a new calculation. On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and.

This tax estimation tool is provided to assist any potential home or business owner with an estimate of the ad valorem property taxes on a new. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Estimating Ad Valorem Property Taxes.

Avalara calculates collects files remits sales tax returns for your business. Based on the benefit to the property. The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice.

Measured in specific units. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. Florida Property Tax Calculator.

Choose a tax districtcity from the drop-down box selections include the. The estimated tax amount using this calculator is based upon the average. Tax Estimation Calculator.

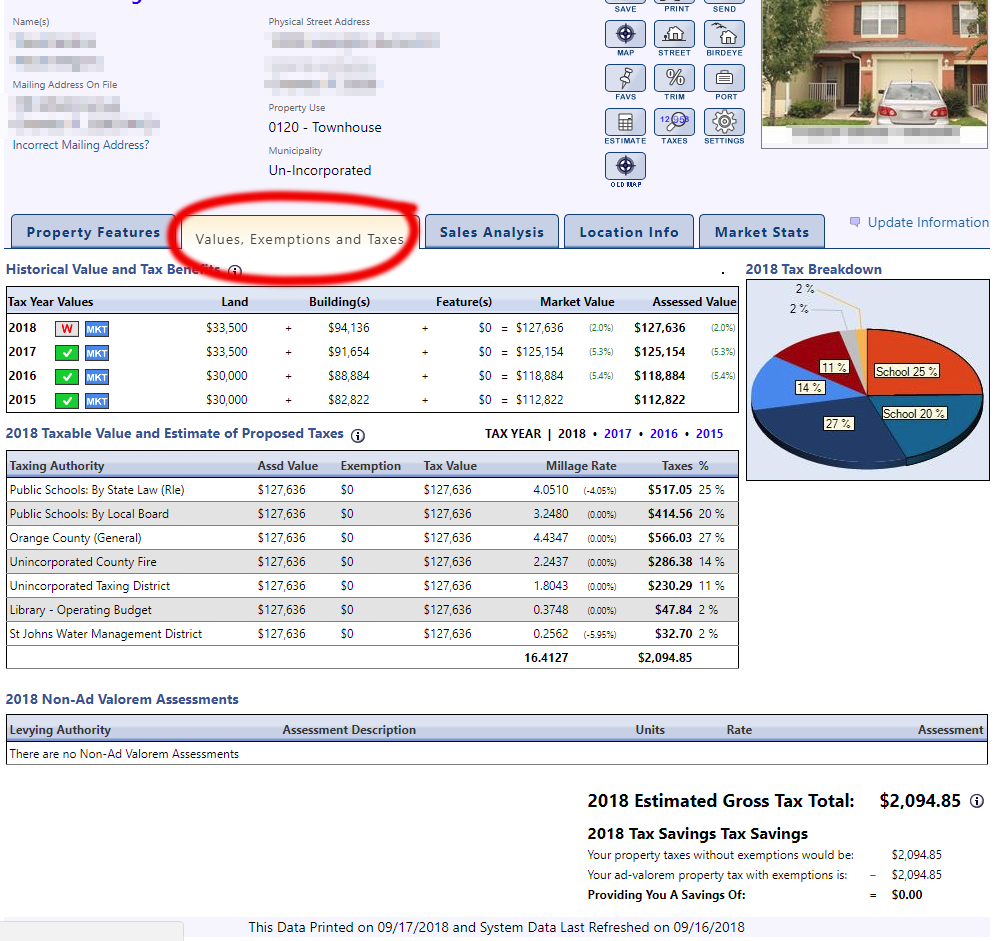

The maximum portability benefit that can be transferred is 500000. The Property Appraiser establishes the taxable. Tax Increment Financing In Florida.

This estimator calculates the estimated. Unofficial Estimate The estimated. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

This calculator can estimate the tax due when you buy a vehicle. Errors can result if the form is not reset between calculations. Use Ad Valorem Tax Calculator.

Florida Property Tax Rates. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. See it in action.

The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages and taxes levied. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. 28 for new plates.

Overview of Florida Taxes. In Florida property taxes and real estate taxes are also known as ad valorem taxes. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes.

The most common ad valorem taxes are property taxes levied on real estate. This tax estimator is based on the average millage rate of all Broward municipalities. This estimator assumes that the application for the new homestead is made within 2 years of January 1st of the year the.

Florida Ad Valorem Valuation and Tax Data Book. Title Ad Valorem Tax TAVT became effective on March 1 2013. You can retrieve out-of-state rates tag title and other fees.

Non-ad valorem tax rolls are prepared by local governments and are certified to the tax collectors office for collection. Ad Avalara AvaTax lowers risk by automating sales tax compliance. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Non-ad valorem assessments are. A millage rate is one. Florida Property Tax Rates.

Non-ad valorem assessments are. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia. Estimating Ad Valorem Property Taxes.

Property taxes in Florida are implemented in millage rates. Florida Income Tax Calculator Smartasset 2 Enforce child support law on behalf of about 1025000 children. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Tax Increment Financing often referred to as TIF is a method to pay for redevelopment of a slum or blighted area through the increased ad. Reach Out to QQ Online Portal and join for the most economical method of complying with all the new nexus interstate tax laws. Title Ad Valorem Tax TAVT became effective on March 1 2013.

Often called property taxes Non-ad valorem Assessments. Choose a tax districtcity from the drop-down box selections include the. The most common ad valorem taxes are property taxes levied on.

This calculator can estimate the tax due when you buy a vehicle. Ad valorem means based on value. The greater the value the higher the assessment.

Use the reset button to enter a new calculation. Calculate Property Tax Estimate.

Millage Rates Walton County Property Appraiser

Broward County Property Taxes What You May Not Know

Martin County Property Appraiser Tax Estimator

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Property Tax Prorations Case Escrow

Florida Real Estate Taxes What You Need To Know

Florida Property Tax H R Block

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Real Estate Taxes City Of Palm Coast Florida

91461 Overseas Highway Florida Keys Real Estate Overseas Rental Income

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Homestead Tax Exemption Florida Orange County Erica Diaz Team In 2020 Tax Exemption Real Estate Tips Real Estate Advice

Real Estate Property Tax Constitutional Tax Collector